FHA Loans in SoCal — Not Just for First-Time Buyers

- Andrew Georgitsis

- Jul 21, 2025

- 2 min read

FHA Loans Can Still Be a Great Deal — Here's When

📍 Introduction

While VA loans are an excellent option for military buyers, FHA loans offer a strong alternative for buyers who may not qualify for VA — or want more flexibility. And no, they’re not just for first-time buyers.

In Southern California, an FHA loan can make homeownership more accessible with lower down payments, flexible credit, and competitive terms.

🏠 What Is an FHA Loan?

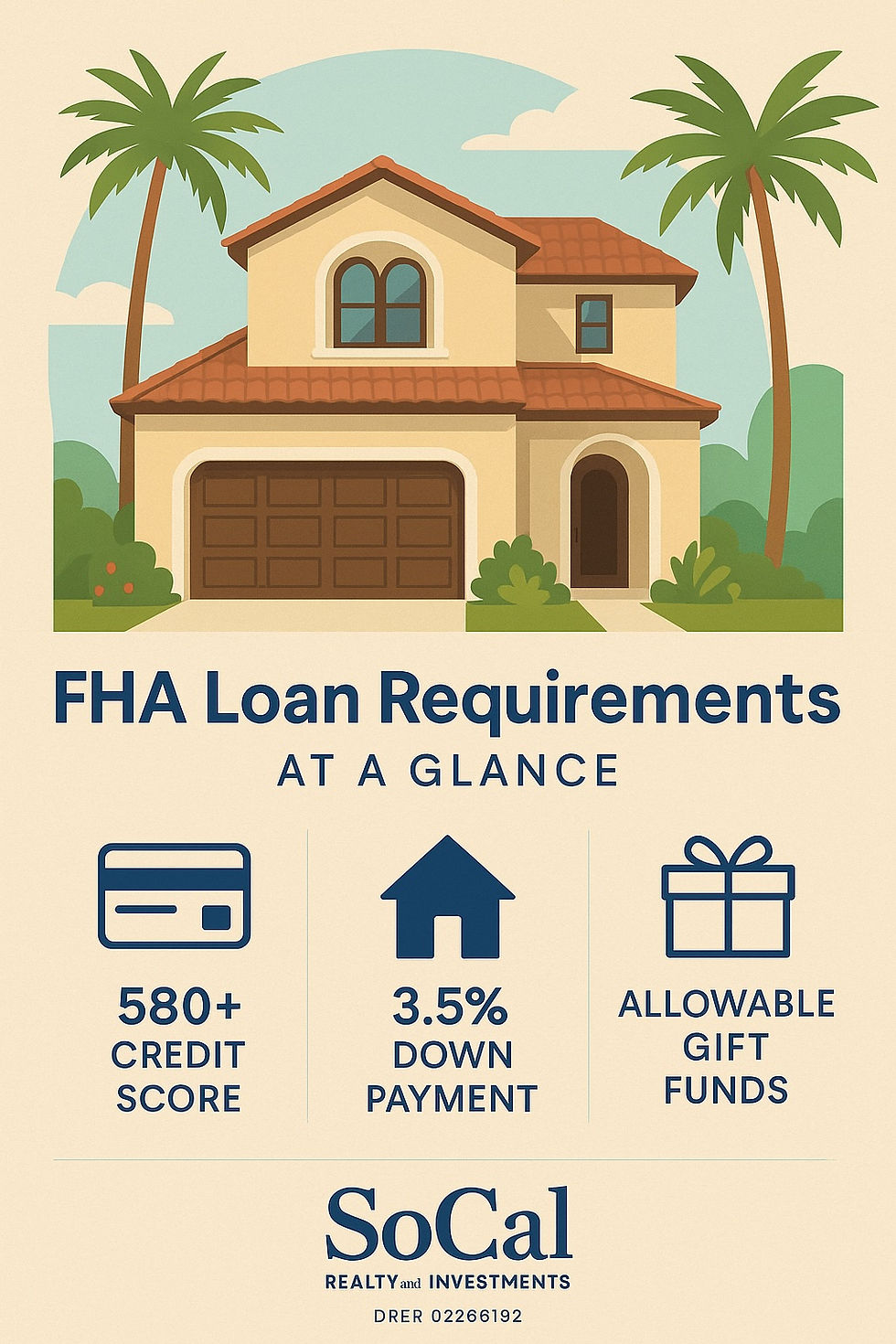

An FHA loan is backed by the Federal Housing Administration and allows:

Credit scores as low as 580

Down payments as low as 3.5%

Flexible debt-to-income ratios

Access to gift funds for closing costs/down payment

✅ Who Should Consider FHA?

Buyers with credit scores under 680

Anyone with limited down payment savings

Buyers recovering from a past bankruptcy or credit event

Those using gift money or assistance programs

📊 Sample FHA Loan Scenario (2025)

Purchase Price: $525,000

Down Payment (3.5%): $18,375

FHA Interest Rate: ~6.25%

Mortgage Insurance: Required (MIP)

Monthly Payment Estimate: ~$3,400✅ More affordable upfront than conventional✅ Lower barriers to qualify✅ Still allows you to buy in SoCal

❌ When FHA May Not Be the Best Fit

If you have 20% down or excellent credit → conventional might be better

If buying a condo, you’ll need to check FHA approval

Mortgage insurance can’t be removed unless you refinance later

💬 Final Thought

Even if you don’t qualify for a VA loan or a conventional mortgage, you still have strong options. FHA loans are versatile, affordable, and designed to open the door to homeownership — especially in competitive markets like SoCal.

📞 Curious if FHA could work for you? We’ll run your numbers and show you your best path forward. 👉 Request FHA loan guidance Or reply with your price range and credit score — we’ll map it out for you.

Comments