top of page

1 (760) 801-6550

Andrew Georgitsis

DRE#02266192

Brokerage: VIP Premier Realty Corp BRE# 02185397

Search

Buyers

🏆 The 3 Types of Buyers Who Will Win Big in 2026

Not All Buyers Will Win in 2026—But These Three Groups Will 🚀 Every real estate year creates winners and spectators.2026 is no different. Some people will: ❌ Watch from the sidelines ❌ Wait too long ❌ Miss equity gains ❌ Overpay later While others will: ✅ Lock in opportunity ✅ Build wealth faster ✅ Leverage changing conditions ✅ Position themselves years ahead So… who are the buyers who will actually win big in 2026 ? It comes down to three powerful buyer profiles —each usin

Andrew Georgitsis

Dec 1, 20253 min read

📉 Why Waiting for Interest Rates to Drop in 2026 Could Cost You Big

Right now, millions of buyers are stuck in this loop: “I’ll buy when rates drop just a little more…” But history shows a brutal truth: 👉 When rates fall, prices rise 👉 When rates fall, competition explodes 👉 When rates fall, buyers lose negotiation power Waiting for rates feels “safe.”Financially—it is often the most expensive move possible . 🧠 The Real 2026 Strategy Smart Buyers Use The smartest buyers: ✅ Buy before rate drops ✅ Lock in price today ✅ Refinance later ✅ Ca

Andrew Georgitsis

Dec 1, 20251 min read

🏘️ Is 2026 a Buyer’s Market or a Seller’s Market? The Real Answer

Here’s the truth most headlines won’t tell you: 👉 2026 is NOT one market. 👉 It’s dozens of micro-markets. In some cities: ✅ Buyers have leverage ✅ Inventory is building ✅ Prices are negotiable In others: 🔥 Sellers still control the game 🔥 Demand outpaces supply 🔥 Multiple offers still happen Both can exist at the same time—just miles apart. 📊 What Defines a Buyer’s Market in 2026? A buyer’s market typically shows: 📦 Higher inventory ⏳ Longer days on market 💸 Seller co

Andrew Georgitsis

Nov 27, 20251 min read

🌴 2026 Southern California Real Estate Market Outlook: What Buyers & Sellers Must Know

Welcome to 2026 — A New Market Cycle Is Here 🚀 If the last few years felt like real estate chaos, 2026 is the year clarity returns . We are officially moving out of: ❌ Panic pricing ❌ Emotional bidding wars ❌ Frozen buyer demand ❌ Fear-based waiting And moving into: ✅ Strategy ✅ Data ✅ Structure ✅ Opportunity 2026 is shaping up to be one of the most strategic real estate years we’ve seen in over a decade. Interest rates are stabilizing, inventory is adjusting, and buyer dema

Andrew Georgitsis

Nov 27, 20252 min read

🪖 The 7 Biggest VA Loan Myths — Busted

If you’ve served our country, you’ve earned one of the most powerful homeownership benefits in America — the VA Loan . Yet, misinformation still keeps many qualified veterans and service members on the sidelines. Let’s clear the air. 💥 Myth #1: You Can’t Get a VA Loan With Bad Credit Truth: There is no set minimum credit score for VA loans.Each lender sets its own standards, and many approve loans even with credit considered “less than perfect.” What matters most is your r

Andrew Georgitsis

Oct 31, 20252 min read

2025 VA Loan Changes Give SoCal Veterans More Power — and Zero Origination Fees

San Diego County’s limit rises to $1,077,000 and Riverside to $806 500— plus new rules that cover buyer-broker fees, TC costs & non-allowable expenses. 🇺🇸 The Big Picture 2025 is a milestone year for veterans and military families using their VA benefit in Southern California. The Department of Veterans Affairs has raised county loan limits, modernized fee structures, and empowered buyers like never before. 📈 New Loan Limits San Diego County: $1,077,000 Riverside & Orange

Andrew Georgitsis

Oct 30, 20252 min read

Why You Should Never Skip Having Your Own Real Estate Agent in California

800 pages of paperwork, strict disclosure laws, and rising lawsuit risks make professional representation essential. ⚖️ The Reality of California Real Estate Real-estate transactions here are legal minefields. With more than 800 pages of required documentation , dozens of disclosures, and new laws every year, one small oversight can cost thousands — or trigger a lawsuit. When you hire a licensed agent through SoCal Realty & Investments , you get a team protecting your intere

Andrew Georgitsis

Oct 29, 20252 min read

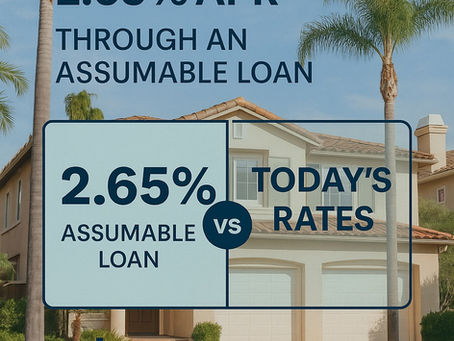

Unlocking Assumable Loans: How Buyers in SoCal Can Score Big

The smart way to step into a low-rate mortgage and save on your monthly payment. When interest rates climbed, many homebuyers feared they’d missed their chance. But there’s a little-known tool that savvy buyers in Southern California are using to gain an edge: assumable loans . What is an Assumable Loan? An assumable loan lets a buyer take over the existing mortgage of the seller — including the rate, remaining term, and balance — rather than starting new credit at current hi

Andrew Georgitsis

Oct 28, 20252 min read

SoCal Buyers Regain Leverage: Why The Market Shift Matters for You

Homes Are Selling Below Asking for the First Time in Six Years Here’s How to Use It to Your Advantage. 🏡 What’s Happening Nationally Redfin’s September 2025 report shows a noticeable cooling. Homes sold for 1.4 % less than final list price—the biggest September discount since 2019. Only 25 % of homes went above asking. Average time on market rose to 50 days . In short, buyers have options , and sellers are having to get realistic. ☀️ The Southern California Angle Locally,

Andrew Georgitsis

Oct 24, 20252 min read

🏡 Why Every Homebuyer Needs a Competitive Market Analysis (CMA)

Buying a home is one of the biggest financial decisions you’ll ever make. While it’s exciting to fall in love with a property, smart...

Andrew Georgitsis

Oct 3, 20252 min read

VA vs. FHA Assumptions – What Buyers & Sellers Need to Know

🌟 Why This Comparison Matters VA and FHA loans are the two most common government-backed mortgages with assumable features. They each...

Andrew Georgitsis

Sep 19, 20253 min read

The 6 Steps to a Successful Assumption

🌟 Make the Most of Assumable Loans With a Clear Process Assumable loans can save buyers thousands of dollars in interest and help...

Andrew Georgitsis

Sep 19, 20252 min read

Your Complete Guide to Successful Assumptions

🌟 Why Assumable Loans Matter Right Now With interest rates still high for new mortgages, assumable loans have become one of the...

Andrew Georgitsis

Sep 19, 20253 min read

Busting the Biggest Myths About Assumable Loans

💡 Why This Matters In today’s shifting market, assumable loans have become one of the most powerful ways to buy and sell homes. Yet,...

Andrew Georgitsis

Sep 19, 20252 min read

🏡 Get a Fixed Rate Home Loan at 2.3% APR — Through an Assumable Loan

Why This Matters Now Mortgage rates today are higher than many buyers would like. But what if you could lock in a rate from years ago —...

Andrew Georgitsis

Sep 4, 20252 min read

Why Now is the Best Time to Buy a Home in Southern California

If you're thinking of buying a home and planning to “wait until interest rates drop,” you're not alone. It’s a common thought—but one that could actually cost you more in the long run. Let’s break down why now may actually be the best time to buy , especially if you're eligible for a VA loan or qualify as a first-time homebuyer . First-Time Buyer Benefits Are Back If you haven’t owned a home in the past three years—or since 2007—you’re officially considered a first-time home

Andrew Georgitsis

Jul 30, 20252 min read

What Happens on Closing Day?

📅 What Happens on Closing Day? You’re almost there! Here’s what to expect—and how to prepare—for the final step in your home buying...

Andrew Georgitsis

Jul 25, 20252 min read

Final Walkthrough — What to Look For Before You Get the Keys

🔍 Final Walkthrough: What to Look For Before You Get the Keys You're almost a homeowner—but before you close, there's one last chance to...

Andrew Georgitsis

Jul 25, 20252 min read

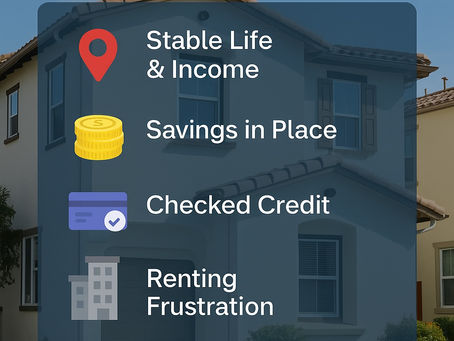

How to Know When You’re Truly Ready to Buy

🧭 How to Know When You’re Truly Ready to Buy There’s no magic moment—but there are signs that you’re closer than you think. 🧠...

Andrew Georgitsis

Jul 25, 20251 min read

Understanding Homeowners Insurance (and What It Covers)

🛡 Understanding Homeowners Insurance (and What It Covers) Buying a home comes with responsibility—but also protection. Homeowners...

Andrew Georgitsis

Jul 25, 20252 min read

bottom of page