Is It Better to Rent or Buy in Southern California?

- Andrew Georgitsis

- Jul 25, 2025

- 2 min read

🏠 Is It Better to Rent or Buy in Southern California?Let’s break it down with facts—not hype.

🌴 Renting vs. Owning—What’s Right for You?

Southern California has sunshine, beaches, and… some of the highest housing costs in the country. So how do you decide whether to rent or buy?

The answer? It depends on your goals, lifestyle, and timeline—but here are the pros and cons that can help you make a confident decision.

🔄 Renting: Pros and Cons

✅ Pros:

No property taxes or maintenance costs

Flexibility to move more easily

Upfront costs (like security deposits) are lower

⚠️ Cons:

Rent increases are likely

No equity or tax benefits

You’re building wealth for someone else

🏡 Owning: Pros and Cons

✅ Pros:

Builds equity and long-term wealth

Mortgage can be fixed—even as rents rise

Tax benefits (mortgage interest, property taxes)

Stability and control over your space

⚠️ Cons:

Higher upfront costs (down payment, closing costs)

Maintenance is your responsibility

Less flexibility if you want to move quickly

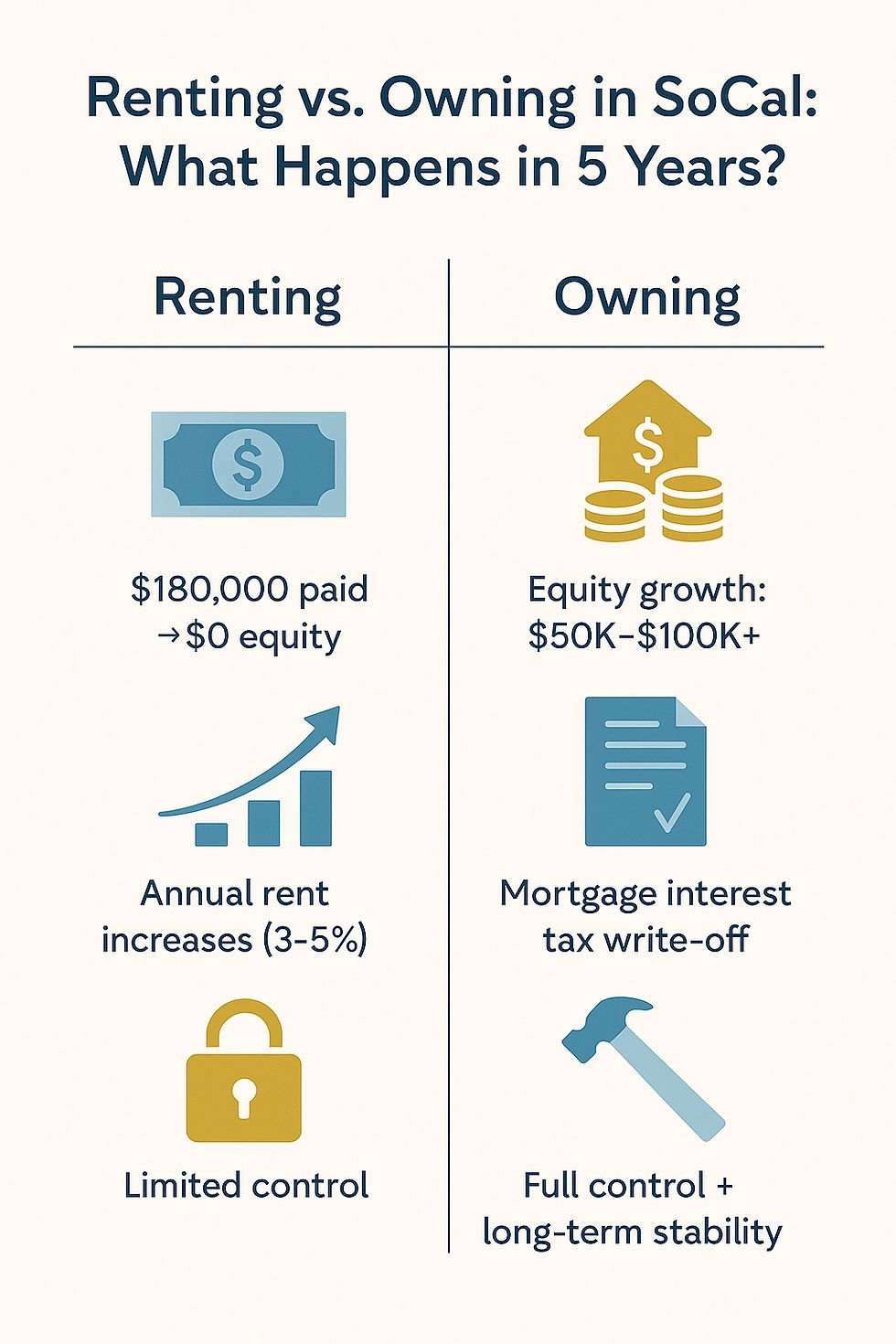

📈 Case Study: Rent vs. Buy at $3,000/Month

If you pay $3,000 in rent for 5 years, you’ll spend $180,000—with $0 equity.

If you buy and pay a $3,000/month mortgage over the same 5 years:

You could build $50,000–$100,000 in equity

You benefit from appreciation and tax write-offs

You still have a place to live—but with ownership

🧠 So, What’s the Right Move for You?

If you plan to stay in one area for 3–5 years or longer, buying often makes better long-term financial sense. But if you’re not quite ready? Renting still offers flexibility—just use the time to prepare for buying down the road.

Either way, we’re here to help you map it out.

—

Andrew Georgitsis DRE#02266192 📧 info@socalrealtyandinvestments.com 📞 866-322-5487 🌐 www.socalrealtyandinvestments.com

Comments